Only six electric vehicles (EVs) currently still qualify for $7,500 federal tax credits after the government changed eligibility requirements in April.

Fortunately, the list includes some of the best-selling EVs on the market, including select trims of the Tesla Model Y SUV and Model 3 sedan, which were, respectively, the first and second most-sold EVs in 2022.

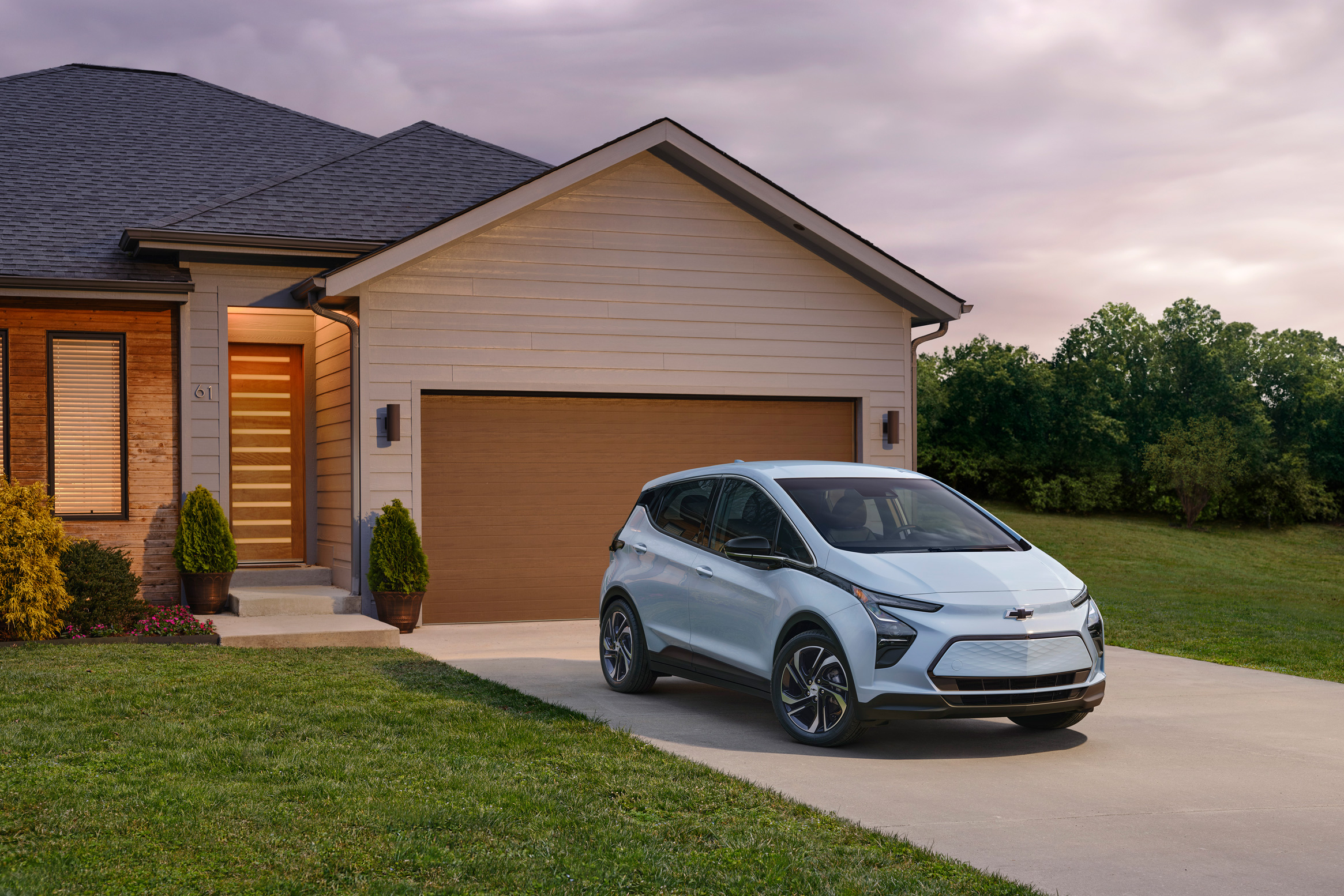

The relatively affordable Chevrolet Bolt EV/EUV subcompact hatchback, which ranked fifth for sales last year, also qualifies. (General Motors, however, is discounting the Bolt car after the 2023 model year.)

Certain trims of the 2023 Ford F-150 Lightning pickup truck — one of the best-rated vehicles among auto experts — continue to qualify for the full tax credit, as do all eight trims of the Volkswagen ID.4 SUV, which Money just picked as our favorite electric SUV for features. Cadillac’s luxury SUV, the Lyriq, rounds out the list.

EV tax credits, explained

More than a dozen vehicles, including several from foreign automakers including BMW, Nissan and Hyundai, became ineligible for the full tax credit when the Treasury Department’s new guidance came out on April 18.

The law governing the tax credits stipulates that vehicles can only qualify if they meet certain battery requirements and pricing thresholds. Additionally, vehicles must be made in North America to qualify for tax credits, which is motivating manufacturers to produce EVs in the continent, according to Cars.com.

Half of the tax credit ($3,750) is contingent on a percentage of an EV’s battery minerals having been extracted or processed in the U.S., “or a U.S. free-trade agreement partner or recycled in North America.” Eligibility for the other half of the credit depends on a percentage of the battery’s components being manufactured and assembled in North America.

From Jan. 1, when the tax credits became available, to April 17, when the party came to an end, the government wasn’t enforcing the battery requirements as it worked to determine which vehicles do and don’t satisfy them.

In the last couple weeks, the list of qualifying vehicles has already changed again, and the group of vehicles that qualify today may look different in a few months. The Volkswagen ID.4, for example, didn’t initially qualify for the tax credit, but the automaker resolved the issue with the government after it secured more documentation from its battery supplier.

In addition to the six vehicles that qualify for $7,500 tax credits, four other models — and an additional Tesla Model 3 trim — qualify for half the credit ($3,750). And in the coming months, three new models will come onto the market that will qualify for $7,500 credits.

Which EVs qualify for tax credits?

Here are the EVs that can qualify for a $7,500 tax credit:

- Cadillac LYRIQ, 2023-2024 (MSRP limit: $80,000)

- Chevrolet Bolt/Bolt EUV, 2022-2023 (MSRP limit: $55,000)

- Ford F-150 Lighting (Extended Range Battery) + F-150 Lightning (Standard Range Battery), 2022-2023 (MSRP limit: $80,000)

- Tesla Model 3 Performance, 2022-2023 (MSRP limit: $55,000)

- Tesla Model Y All-Wheel Drive/Model Y Long Range All-Wheel Drive/Model Y Performance, 2022-2023 (MSRP limit: $80,000)

- Volkswagen ID.4, 2023 (MSRP limit: $80,000)

- Chevrolet Blazer, 2024 — available summer 2023 (MSRP limit: $80,000)

- Chevrolet Equinox, 2024 — available fall 2023 (MSRP limit: $80,000)

- Chevrolet Silverado, 2024 — available fall 2023 (MSRP limit: $80,000)

These EVs can qualify for a $3,750 tax credit:

- Ford E-Transit, 2022-2023 (MSRP limit: $80,000)

- Ford Mustang Mach-E (Extended Range Battery)/Mustang Mach-E (Standard Range Battery), 2022-2023 (MSRP limit: $80,000)

- Rivian R1S, 2023 (MSRP limit: $80,000)

- Rivian R1T, 2023 (MSRP limit: $80,000)

- Tesla Model 3 Standard Range Rear Wheel Drive, 2022-2023 (MSRP limit: $55,000)

Which PHEVs still qualify for tax credits?

Americans who buy certain plug-in hybrids (PHEVs) can also take advantage of tax credits. Two PHEVs qualify for the full credit and four more qualify for a $3,750 credit.

Here are the PHEVs that can qualify for a $7,500 tax credit:

- Chrysler Pacifica PHEV, 2022-2023 (MSRP limit: $80,000)

- Lincoln Aviator Grand Touring, 2022-2023 (MSRP limit: $80,000)

These PHEVs can qualify for a $3,750 tax credit:

- Ford Escape Plug-in Hybrid, 2022-2023 (MSRP limit: $80,000)

- Jeep Grand Cherokee PHEV 4xe, 2022-2023 (MSRP limit: $80,000)

- Jeep Wrangler PHEV 4xe, 2022-2023 (MSRP limit: $80,000)

- Lincoln Corsair Grand Touring, 2022-2023 (MSRP limit: $80,000)

If you purchased a vehicle before April 18 or have questions about tax credits for used EV purchases, more information is available here.